1) The Banking GenAI Architecture 2) The FCA - NVIDIA deal 3) Money20/20 Europe Key Topics

Welcome to my newsletter! Each week a few hand-picked topics from the world of fintech, payments and banking with behind-the-scenes analysis!

1) The Banking GenAI Architecture

Banks’ biggest tech challenge isn’t upgrading legacy systems- it’s integrating an entirely new (Gen)AI layer with orchestration in the lead. And making it work across functions.

Too many banks often start with the wrong focus. Whereas dealing with legacy infrastructure is inevitable, it can become a blind spot without the right understanding of what it needs to achieve.

Delivering agile, intelligent services that anticipate customer needs should be the goal.

Here is a high-level overview of how the back end can be adjusted:

𝟭. 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 𝗲𝗻𝗴𝗶𝗻𝗲:

- An orchestration layer sits atop core systems, routing everything - from customer questions to fraud alerts - to the right AI service.

- Modern APIs abstract legacy systems into modular services, so AI features can be added or swapped without changing existing workflows.

𝟮. 𝗥𝗲𝗮𝗹-𝘁𝗶𝗺𝗲 𝗶𝗻𝗳𝗿𝗮𝘀𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗲:

- Real-time data feeds stream transactions, balance changes and logins as they happen.

- A unified data hub brings together customer details, activity patterns and risk ratings so every AI tool works from the same information.

𝟯. 𝗗𝗮𝘁𝗮-𝗱𝗿𝗶𝘃𝗲𝗻 𝗶𝗻𝘀𝗶𝗴𝗵𝘁𝘀:

- Requests are automatically enriched with live account balances, recent transactions and open support tickets - ensuring the AI’s output reflects up-to-date information.

- Data is fetched on demand from indexed records, so the AI stays current without the expense of retraining the entire model for every update.

𝟰. 𝗦𝗲𝗰𝘂𝗿𝗶𝘁𝘆 & 𝗴𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲:

- Data stays encrypted end-to-end, from intake to AI output.

- Automated audits flag bias and log every decision.

- Failure simulations uncover hidden risks before they impact customers.

𝟱. 𝗠𝗼𝗱𝘂𝗹𝗮𝗿 𝘀𝗲𝘁-𝘂𝗽:

- Modern interfaces turn core banking, payment and CRM systems into plug-and-play modules.

- Behind the scenes, back-end services can be updated piece by piece without interrupting the AI layer.

𝟲. 𝗜𝗻𝘁𝗲𝗴𝗿𝗮𝘁𝗲𝗱 𝗱𝗲𝗹𝗶𝘃𝗲𝗿𝘆 𝘁𝗲𝗮𝗺𝘀:

- Small, cross-functional teams manage everything from data ingestion to model deployment and monitoring.

- Defined roles and fast feedback loops keep projects compliant and focused on real customer needs.

The GenAI layer doesn’t just sit on top of the existing setup – it’s a complete overhaul of the tech architecture and the business logic behind it.

Opinions: Panagiotis Kriaris, Graphic source: BCG

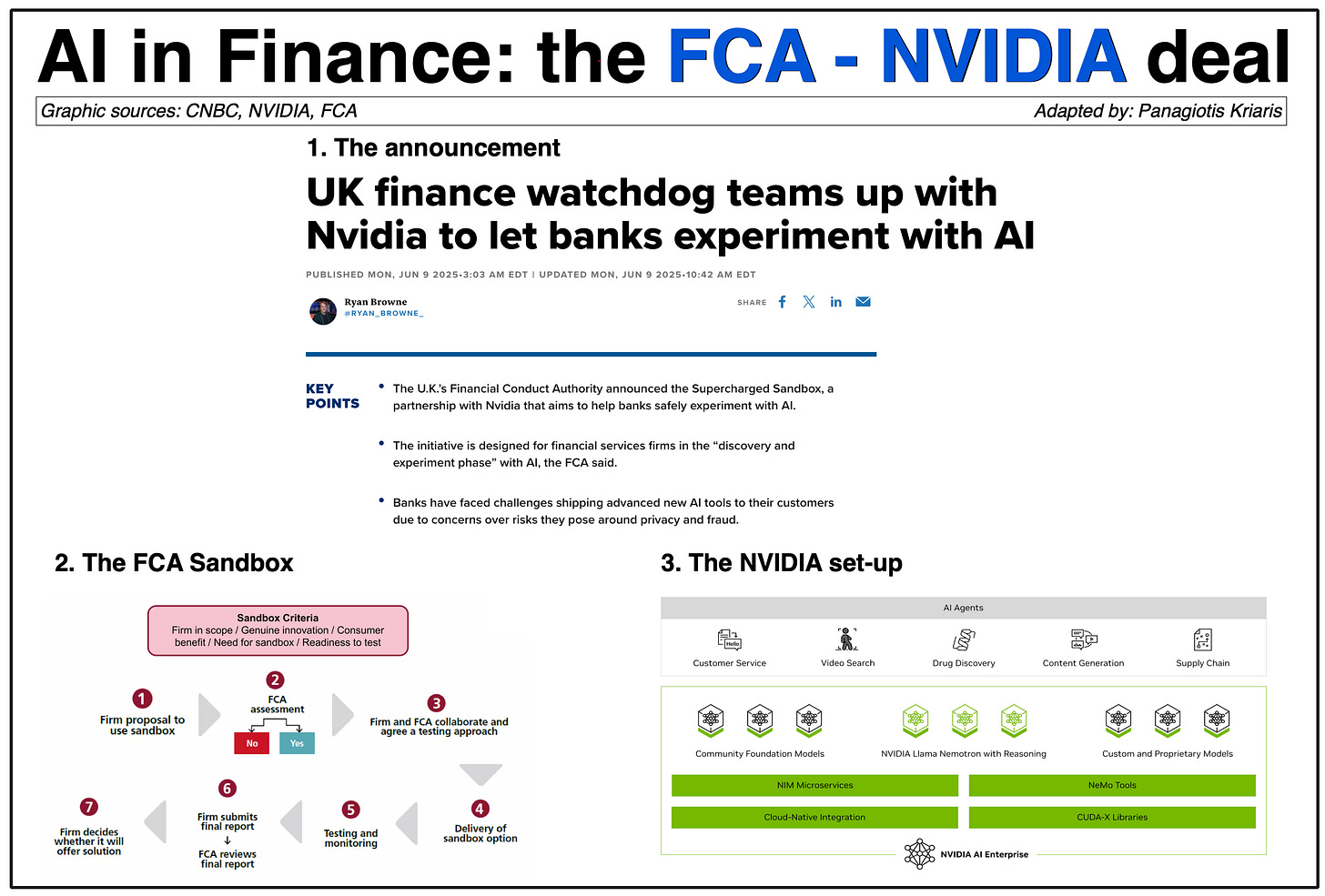

2) The FCA - NVIDIA deal

This is a major announcement that has the potential to redefine how AI is developed, tested, and adopted across financial services

𝗪𝗵𝗮𝘁 𝘄𝗮𝘀 𝗮𝗻𝗻𝗼𝘂𝗻𝗰𝗲𝗱?

- The UK’s Financial Conduct Authority (FCA) and NVIDIA are launching a “Supercharged Sandbox” for financial services.

- The sandbox will give firms access to better data, technical expertise and regulatory support to speed up innovation.

- It is open to any financial services firm looking to innovate and experiment with AI.

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗮 𝘀𝗮𝗻𝗱𝗯𝗼𝘅?

- A sandbox is a safe testing space where companies can try out new technologies and products.

- It lets firms experiment with real data and customers, but in a controlled and supervised environment.

- Regulators oversee the process, helping spot problems early and protect consumers.

- The goal: encourage innovation without putting the whole system or customers at risk.

𝗪𝗵𝘆 𝗮𝗿𝗲 𝗡𝗩𝗜𝗗𝗜𝗔 𝗮𝗻𝗱 𝘁𝗵𝗲 𝗙𝗖𝗔 𝗽𝗮𝗿𝘁𝗻𝗲𝗿𝗶𝗻𝗴?

- NVIDIA gets to showcase its AI technology to real-world financial businesses and regulators.

- The FCA gains access to world-class computing and expertise, making it easier for smaller players to innovate.

- Both want to test how AI can be used safely, responsibly, and effectively in finance.

- It’s a win-win: a technology leader and a regulator team up to set new standards for the industry.

𝗪𝗵𝘆 𝗻𝗼𝘄 𝗮𝗻𝗱 𝘄𝗵𝘆 𝗱𝗼𝗲𝘀 𝗶𝘁 𝗺𝗮𝘁𝘁𝗲𝗿?

- AI is advancing rapidly, and finance stands to benefit - or lose - the most from its adoption.

- By acting now, the UK aims to stay ahead of the curve, supporting growth while managing risks.

- Safe, controlled experimentation can drive innovation and consumer trust.

- The timing reflects a push to boost UK competitiveness in global fintech and AI.

𝗪𝗶𝗱𝗲𝗿 𝗶𝗻𝗱𝘂𝘀𝘁𝗿𝘆 𝗶𝗺𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀:

- Levels the playing field so small fintechs can access the same tools as big banks.

- Sets an example that other countries and regulators are likely to follow.

- Could speed up the adoption of AI-driven solutions in financial services.

- Marks a shift toward closer collaboration between regulators and technology companies.

𝗪𝗵𝗮𝘁’𝘀 𝗻𝗲𝘅𝘁?

- Applications are open; selected projects kick off in October 2025.

- Early trials are expected to focus on preventing fraud, market abuse, and improving customer service.

- Success could mean broader rollouts and inspire similar sandboxes globally.

- The partnership might spark bigger investments in AI talent and infrastructure across the UK.

Opinions: Panagiotis Kriaris, Graphic sources: CNBC, NVIDIA, FCA

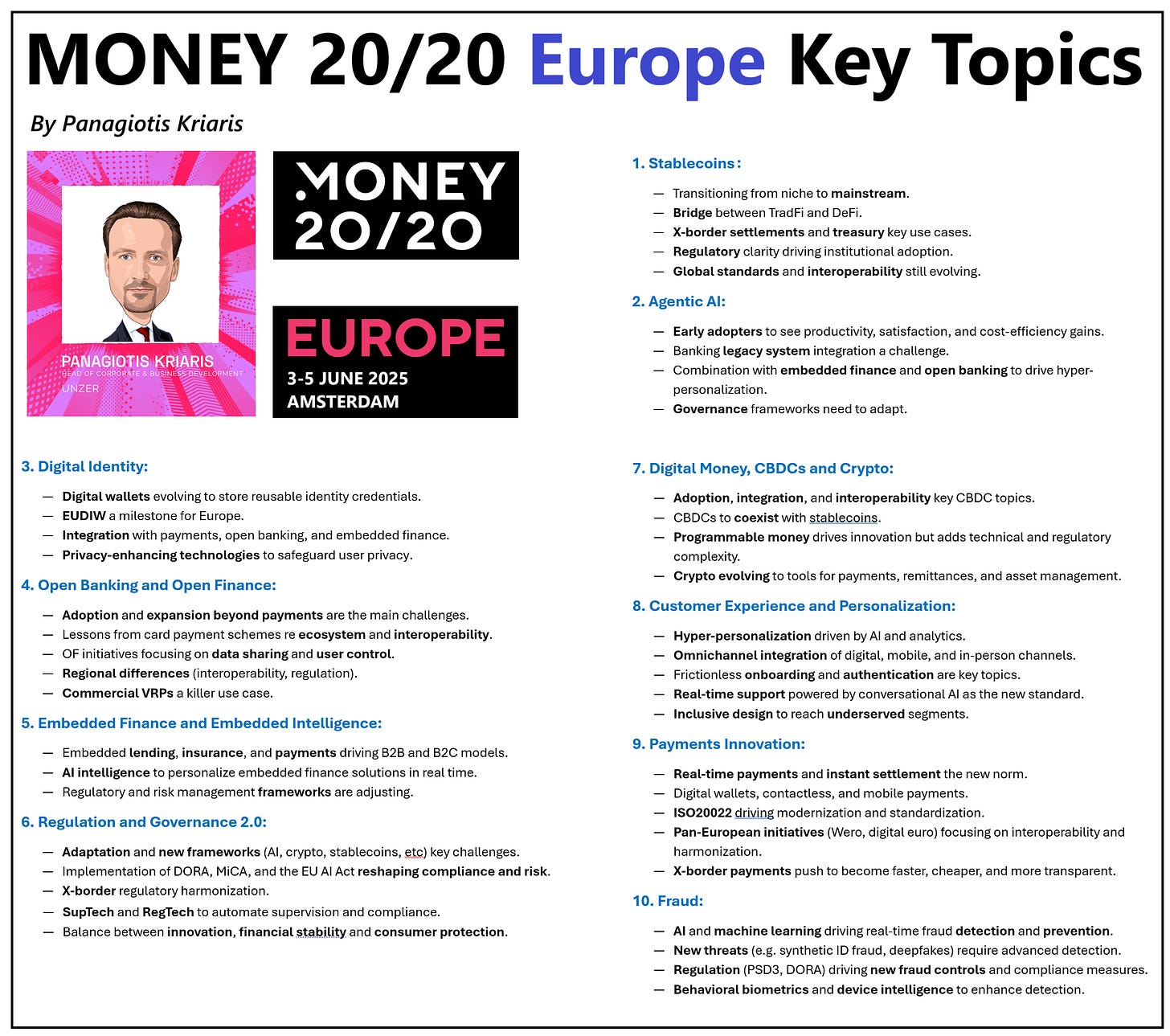

3) Money20/20 Europe Key Topics

Wrapping up an exciting Money2020 Europe with my personal take on the top themes.

1. Stablecoins:

— From niche to mainstream.

— TradFi - DeFi bridge.

— X-border settlements and treasury use cases.

— Regulation driving institutional adoption.

— Global standards and interoperability still evolving.

2. Agentic AI:

— Early adopters to see productivity, satisfaction, and cost-efficiency gains.

— Banking legacy system integration a challenge.

— Combination with embedded finance and open banking.

3. Digital Identity:

— Digital wallets evolving to store identity.

— EUDIW a milestone for Europe.

— Integration with payments, open banking, and embedded finance.

— Privacy-enhancing technologies to safeguard user privacy.

4. Open Banking and Open Finance:

— Adoption and expansion beyond payments - main challenges.

— Lessons from card payment schemes (ecosystem, interoperability).

— OF initiatives focusing on data sharing and user control.

— Regional differences.

— Commercial VRPs a killer use case.

5. Embedded Finance:

— Embedded lending, insurance, and payments.

— AI intelligence to personalize embedded finance solutions in real time.

— Regulatory and risk management frameworks are adjusting.

6. Regulation and Governance 2.0:

— Adaptation and new frameworks key challenges.

— Implementation of DORA, MiCA, and the EU AI Act reshaping compliance and risk.

— X-border regulatory harmonization.

— SupTech and RegTech to automate supervision and compliance.

— Balance between innovation, financial stability and consumer protection.

7. Digital Money, CBDCs and Crypto:

— Adoption, integration, and interoperability key CBDC topics.

— CBDCs to coexist with stablecoins.

— Programmable money: innovation with technical and regulatory complexity.

8. Customer Experience and Personalization:

— Hyper-personalization driven by AI and analytics.

— Omnichannel integration of digital, mobile, and in-person channels.

— Frictionless onboarding and authentication key topics.

— Real-time support powered by conversational AI as the new standard.

— Inclusive design to reach underserved segments.

9. Payments Innovation:

— Real-time payments and instant settlement the new norm.

— Digital wallets, contactless, and mobile payments.

— ISO20022 driving modernization and standardization.

— Wero and digital euro focusing on interoperability and harmonization.

— X-border payments push to become faster, cheaper, and more transparent.

10. Fraud:

— AI and machine learning driving real-time fraud detection and prevention.

— New threats (e.g. synthetic ID fraud, deepfakes) require advanced detection.

— Regulation (PSD3, DORA) driving new fraud controls and compliance measures.

— Behavioral biometrics and device intelligence to enhance detection.

Opinions: Panagiotis Kriaris