1) Stablecoins in x-border payments 2) Nubank at a glance 3) Revolut's 2024 results

Welcome to my newsletter! Each week hand-picked topics from the world of fintech, payments and banking with behind-the-scenes analysis!

1) Stablecoins in x-border payments

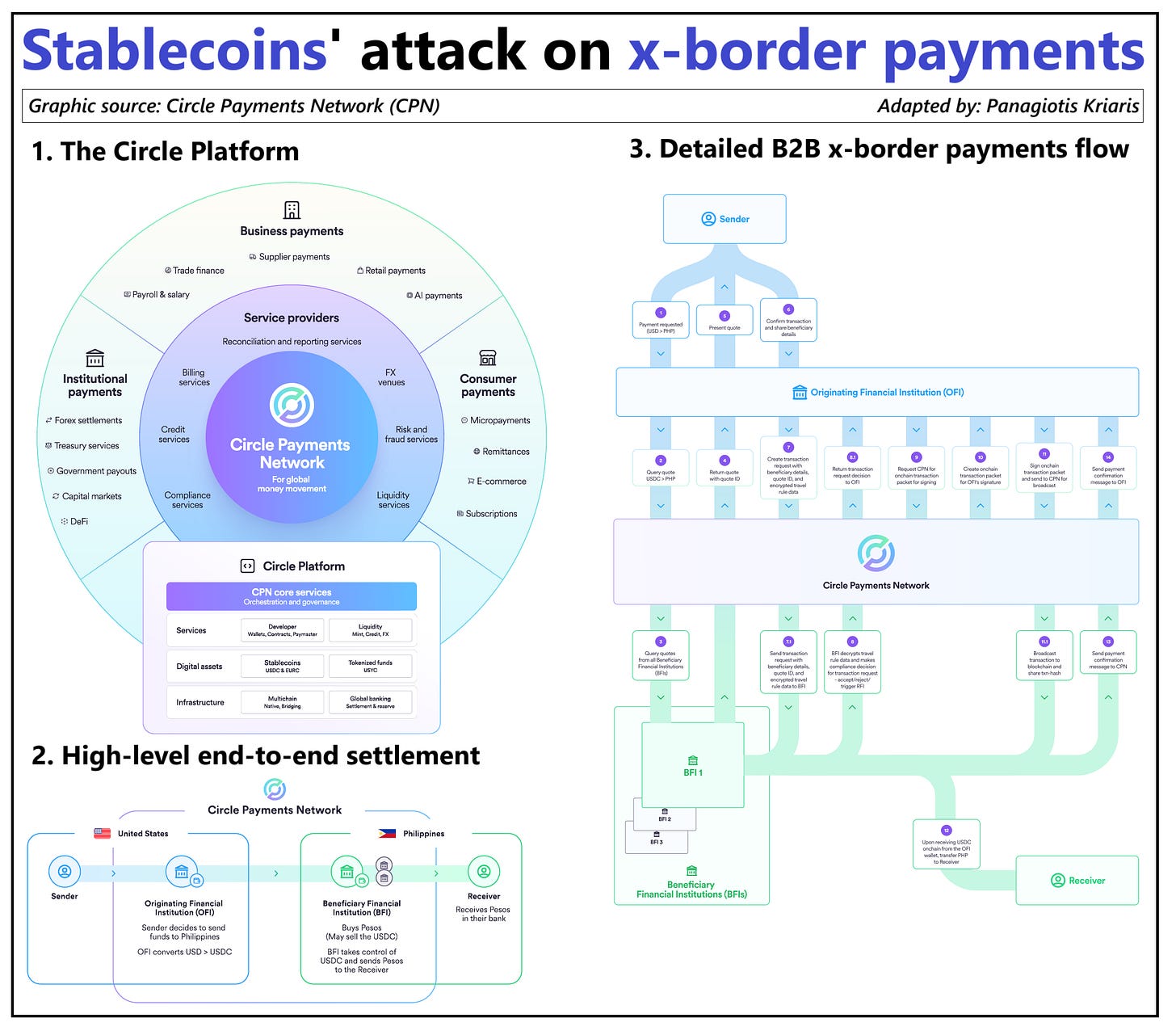

Stablecoin is going big after cross-border payments. Circle’s newly announced CPN (Circle Payments Network ) is not the first stablecoin-based attempt but it’s the most ambitious so far. Let’s take a look.

Cross-border payments are a $290 billion revenue opportunity (McKinsey). Compared to domestic payments, cross-border payments are notoriously more inefficient with high costs, limited transparency and slow response times. Legacy technology, complex processes and outdated data formats are some of the main culprits.

Stablecoins like USDC (Circle) and USDT (Tether) have already been used for cross-border payments, and major payment companies such as Visa and PayPal have explored stablecoin-powered international transfers, with PayPal even launching its own stablecoin (PUSD) for cross-border use.

𝗪𝗵𝗮𝘁 𝘀𝗲𝘁𝘀 𝗖𝗣𝗡 𝗮𝗽𝗮𝗿𝘁 𝗶𝘀 𝗶𝘁𝘀 𝘀𝗰𝗮𝗹𝗲 𝗮𝗻𝗱 𝗶𝗻𝘀𝘁𝗶𝘁𝘂𝘁𝗶𝗼𝗻𝗮𝗹 𝗳𝗼𝗰𝘂𝘀:

1. Circle is collaborating with major global banks (Standard Chartered, Deutsche Bank, Santander, Société Générale) and fintechs to create a real-time, programmable, and compliance-focused network that directly connects financial institutions for seamless cross-border settlements using regulated stablecoins like USDC and EURC.

2. CPN does not move funds directly; rather, it serves as a marketplace of financial institutions and acts as a coordination protocol that orchestrates global money movement and the seamless exchange of information.

3. As the network operator, Circle defines the CPN protocol and provides application programming interfaces (APIs), software development kits (SDKs) and public smart contracts to orchestrate global money movement.

4. While other stablecoin initiatives have targeted cross-border payments, CPN marks the first time a regulated settlement asset in the form of stablecoins is married with an institutional coordination and governance layer purpose-built for financial institutions. This integration connects traditional payment systems to assets like USDC and EURC, while establishing a trusted counterparty framework for more efficient settlement with fewer intermediaries.

5. By introducing a new ‘clearing layer’ based on compliant, always-on digital dollars, CPN wants to lay the foundation for cross-border settlement at internet scale.

𝗧𝗵𝗶𝘀 𝗶𝘀 𝗵𝗼𝘄 𝗶𝘁 𝘄𝗼𝗿𝗸𝘀:

1. Sender sends $1000 to a receiver in Philippines via CPN

2. CPN (via the originating financial institution) converts USD to USDC

3. CPN connects to a beneficiary financial institution in the Philippines that converts USDC to Pesos and sends to the receiver

4. The receiver receives Pesos in their bank

What do you think, can Circle challenge traditional payment rails?

Opinions: my own, Graphics and sources: Circle Payments Network

2) Nubank at a glance

Nubank’s story has a Hollywood flavour: an outsider spots a market gap and re-writes the rules. Today with 100mn+ customers, it ranks among the world’s biggest digital banks. Here’s how it all started.

David Vélez is one of Nubank’s three co-founders. And he’s not even from Brazil - Nubank’s main market. He grew up in Colombia and Costa Rica. Back in 2012, he was working at VC firm Sequoia Capital. When researching companies to invest in across Latin America, one problem kept showing up: banking was broken.

A few large banks dominated Brazil's economy. They charged some of the highest fees in the world, had clunky user experiences, and no incentive to change. There were no startups in financial services - and no one trying to fix it.

So David decided to start one.

Here is how he pulled it off - in his own narrative (Crucible Moments podcast):

• 𝗖𝘂𝘀𝘁𝗼𝗺𝗲𝗿 𝗰𝗲𝗻𝘁𝗿𝗶𝗰𝗶𝘁𝘆 𝗻𝗼𝘁 𝗮𝘀 𝗮 𝗯𝘂𝘇𝘇-𝘄𝗼𝗿𝗱: Nubank was founded on a simple insight: customers want to be treated well. David found a large market dominated by a few companies who treated customers badly. By obsessing over customer experience and consistently choosing customer interests over short-term profits, Nubank built an emotional connection that became their strongest competitive advantage.

• 𝗧𝗿𝗮𝗻𝘀𝗽𝗮𝗿𝗲𝗻𝗰𝘆 𝗮𝘀 𝗮 𝗰𝗿𝗶𝘀𝗶𝘀 𝘁𝗼𝗼𝗹: When regulatory changes threatened Nubank’s existence, leadership chose brutal honesty with employees over false comfort. Being transparent in moments of crisis - especially when you don’t have all the answers - builds trust and rallies the team around solving seemingly impossible challenges.

• 𝗕𝘂𝗶𝗹𝗱 𝘆𝗼𝘂𝗿 𝘁𝗲𝗮𝗺 𝗮𝗿𝗼𝘂𝗻𝗱 𝘆𝗼𝘂𝗿 𝗴𝗮𝗽𝘀: As an outsider to Brazilian banking and technology, David focused on finding co-founders who could fill his critical weaknesses - bringing on Cristina Junqueira for her deep understanding of Brazilian banking and Edward Wible for technical leadership.

• 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗶𝗼𝗻 𝗮𝘀 𝗮 𝗰𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝘃𝗲 𝗮𝗱𝘃𝗮𝗻𝘁𝗮𝗴𝗲: Rather than fighting regulators, Nubank aimed at a compliance-first approach that turned potential adversaries into allies and created barriers to entry that protected the business as it scaled.

• 𝗧𝗵𝗶𝗻𝗸 𝗯𝗶𝗴 𝗯𝘂𝘁 𝘀𝘁𝗮𝗿𝘁 𝗳𝗼𝗰𝘂𝘀𝗲𝗱: Although Nubank’s ultimate vision was to reinvent banking globally, they started with a single product (credit cards) in a single market (Brazil). This focused approach allowed them to build a strong foundation before expanding to multiple products and countries.

• 𝗖𝘂𝗹𝘁𝘂𝗿𝗲 𝗶𝘀𝗻’𝘁 𝘄𝗵𝗮𝘁 𝘆𝗼𝘂 𝘀𝗮𝘆 𝗯𝘂𝘁 𝘄𝗵𝗮𝘁 𝘆𝗼𝘂 𝗱𝗼: Nubank’s decision to reverse fees when they failed to send payment reminders - even though it hurt profits - showed employees and customers alike that their values weren’t just marketing speak.

Opinions: my own, Graphics: WhiteSight, Learnings: Crucible Moments, Sequoia Capital podcast

3) Revolut's 2024 results

Revolut just dropped its 2024 results. And they are impressive. Net profit at $1.5bn, up 149% year-on-year. This is my take what’s behind the numbers.

2024 Numbers:

· Net profit surged 149% to £1.1B

· Revenue up 72% to £3.1B

· Wealth revenues (incl. crypto) grew 298% to £506M

· Loan book hit £979M (↑86%), interest income up 58%

· Customer base topped 52.5M, with nearly 15M new users

Main success drivers:

1. Diversified revenue streams: cards, payments, FX, subscriptions, crypto, and interest income - no single product or geography dominates, reducing risk

2. Hyper-efficient scale: Strong profit margins despite rapid expansion.

3. Product explosion: Mortgages in testing, IBAN rollout, RevPoints loyalty, crypto exchange (Revolut X), BNPL, personal loans, credit cards

4. Wealth division (stock and crypto trading) saw explosive growth, especially with the 2024 crypto resurgence

5. Referral flywheel: 70% of new users via referrals.

6. Aggressive expansion into new markets (e.g., New Zealand, Brazil, Mexico)

7. Global momentum: Launches in Brazil, Mexico, and New Zealand.

8. Continued profitability while scaling, with net profit margins improving as the business grows

9. UK banking license to unlock new growth (lending, deposits)

Challenges:

1. Primary banking adoption: Many still use Revolut as a secondary account - key hurdle to drive deposit-based lending.

2. Focus on better managing fraud, particularly APP scams, particularly as Revolut scales.

3. Ongoing regulatory scrutiny, especially as Revolut transitions to full banking status and expands into new markets

4. Maintaining high growth rates in customer acquisition and revenue diversification as the business matures and competition intensifies

5. Balancing innovation and risk, especially in volatile segments like crypto trading

6. Increased competition from both fintech rivals and traditional banks, especially as it broadens its product suite and targets more mainstream banking customers

Revolut’s record-breaking growth highlights the strength of its diversified model, however key challenges remain.

What do you think should be the number one focus area?

Opinions: my own