1) JPMorgan vs Fintechs 2) Fintech Unicorns 2025 3) GenAI in Payments 4) Citi vs JPMorgan Stablecoin Play 5) Ant International's Stablecoin Play

Welcome to my newsletter! Each week a few hand-picked topics from the world of fintech, payments and banking with behind-the-scenes analysis!

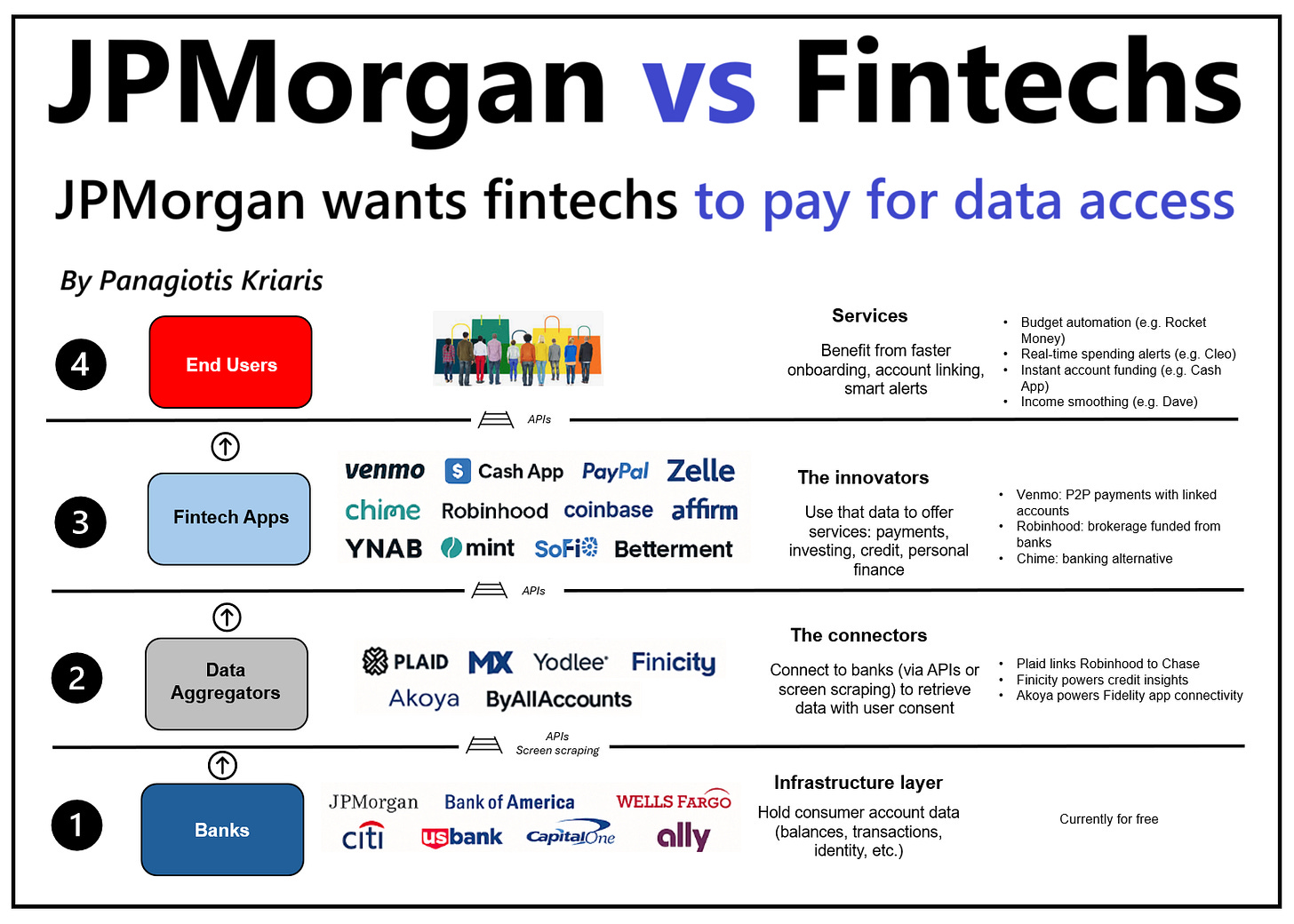

1) JPMorgan vs Fintechs

JP Morgan wants fintechs to pay up for data access. But this isn’t about pricing. It’s about who controls the consumer finance digital rails in the U.S.

𝗝𝗣𝗠𝗼𝗿𝗴𝗮𝗻’𝘀 𝗽𝗹𝗮𝗻

— Bloomberg reported that JPMorgan Chase has sent pricing sheets to U.S. data aggregators like Plaid and MX, outlining new fees for access to consumer bank data.

— These aggregators connect banks and fintech apps (like Venmo, Robinhood, Coinbase) - enabling payments, account verification, and real-time balance syncing.

— Charges vary by use case, with payment-related activity facing the highest fees.

— In some cases, costs could exceed 1,000% of the revenue per transaction - threatening fintech business models.

𝗧𝗵𝗲 𝗯𝗮𝗰𝗸𝗴𝗿𝗼𝘂𝗻𝗱

— JPMorgan has long argued that fintechs use bank infrastructure without paying for it or assuming responsibility for fraud, security, or compliance risks.

— CEO Jamie Dimon has pushed for tighter control over who accesses bank data and how it’s monetized - a position he’s made clear in shareholder letters.

— In 2023, the Consumer Financial Protection Bureau (CFPB) - the U.S. consumer finance regulator - introduced a rule requiring banks to share customer data for free if users consented.

— But the rule was never enforced. After lawsuits from major banks, the CFPB moved in 2025 to vacate the rule - making its reversal virtually certain.

𝗪𝗵𝗼’𝘀 𝗮𝗳𝗳𝗲𝗰𝘁𝗲𝗱?

This move touches nearly every layer of the U.S. fintech ecosystem:

1. Fintech apps (Venmo, Robinhood, Coinbase, etc) that rely on real-time account access.

2. Crypto wallets that fund and withdraw through bank connections.

3. Retail brokers that enable instant transfers and syncing.

4. Personal finance tools like Rocket Money and YNAB.

5. Lenders and BNPL providers that use bank data to assess creditworthiness.

6. Data aggregators whose economics may be disrupted overnight.

7. And ultimately - consumers, who could face degraded services, slower onboarding, or higher costs.

𝗕𝗮𝗻𝗸𝘀 𝘃𝘀 𝗙𝗶𝗻𝘁𝗲𝗰𝗵𝘀

— Unlike the UK and EU, where Open Banking frameworks require banks to share data with regulated third parties for free, the U.S. has historically taken a market-driven approach - letting private deals between banks, aggregators, and fintechs define access.

— The CFPB’s 2023 rule marked a shift toward regulation, requiring banks to share data with consent.

— With the rule stalled, banks like JPMorgan are moving to assert control, introducing fees for access that was previously free.

— This marks a new phase in the long-running tension: banks aim to monetize the infrastructure, while fintechs depend on low-friction access to build consumer-facing services.

After years of fintech-led innovation built on free access, the balance of power in the U.S. may be tilting back to incumbents.

Opinions: Panagiotis Kriaris

2) Fintech Unicorns 2025

This is the 2025 fintech unicorn list. But valuations, fundamentals, and investor expectations have completely changed. This is my take.

𝟭. 𝗩𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻𝘀 𝗵𝗮𝘃𝗲 𝗿𝗲𝘀𝗲𝘁

The 2021 highs were unsustainable. The correction that followed wiped out inflated multiples but forced companies to get serious about product-market fit, monetization, and real-world traction. A $5B valuation today means something fundamentally different than it did four years ago.

𝟮. 𝗜𝗻𝗳𝗿𝗮𝘀𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗲 𝗶𝘀 𝘁𝗵𝗲 𝗻𝗲𝘄 𝗻𝗮𝗺𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗴𝗮𝗺𝗲

The standout companies aren’t just building apps or enabling slick UX - They’re becoming essential layers in the financial services stack. APIs, orchestration layers, compliance tooling, embedded payments - these are the new growth drivers.

𝟯. 𝗧𝗵𝗲 𝗔𝗜 𝗽𝗹𝗮𝘆

Fintechs are no longer just experimenting with AI - they’re embedding it into risk, onboarding, personalization, fraud, and servicing. The most forward-looking unicorns are building agentic, decision-making layers that automate complexity at scale. It’s not about chatbots anymore - it’s about intelligent orchestration across the entire financial stack.

𝟰.𝗣𝗿𝗼𝗳𝗶𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝗶𝘀 𝗸𝗲𝘆

The “growth at all costs” playbook is a thing of the past. Fintech unicorns are being pushed - by investors and the market - to show sustainable business models. Profitability (or a credible path to it) is now a baseline requirement.

𝟱.𝗧𝗵𝗲 𝗽𝗹𝗮𝘁𝗳𝗼𝗿𝗺 𝗽𝗹𝗮𝘆

Fintechs that started with a narrow focus - solving a specific pain point like onboarding, payouts, or FX - are now under pressure to broaden their scope. To reach and sustain unicorn status, they need to evolve into platforms: integrated, multi-service offerings that connect identity, payments, credit, and compliance. Scale now comes from depth, interoperability, and becoming indispensable across multiple touchpoints.

𝟲.𝗧𝗵𝗲 𝗨.𝗦. 𝗿𝗲𝗺𝗮𝗶𝗻𝘀 𝗺𝗮𝗿𝗸𝗲𝘁 𝗱𝗿𝗶𝘃𝗲𝗻

With no regulated Open Banking framework in place, U.S. fintechs scale by negotiating access rather than relying on standards. The model rewards speed and connections - but creates fragility. Moves like JPMorgan charging for data access show how quickly power can shift, making long-term innovation harder to sustain.

𝟳.𝗙𝗶𝗻𝘁𝗲𝗰𝗵𝘀 𝗹𝗲𝗮𝗱 𝗠&𝗔

Fintechs lead M&A probability rankings because they offer strategic utility at more grounded valuations. Their modular, API-driven models solve core problems banks and platforms would rather buy than build - making them ideal targets in a market shifting from hype to hard value.

Opinions: Panagiotis Kriaris, Graphic source: CB Insights https://www.cbinsights.com/research/report/unicorn-startups-valuations-headcount-investors/

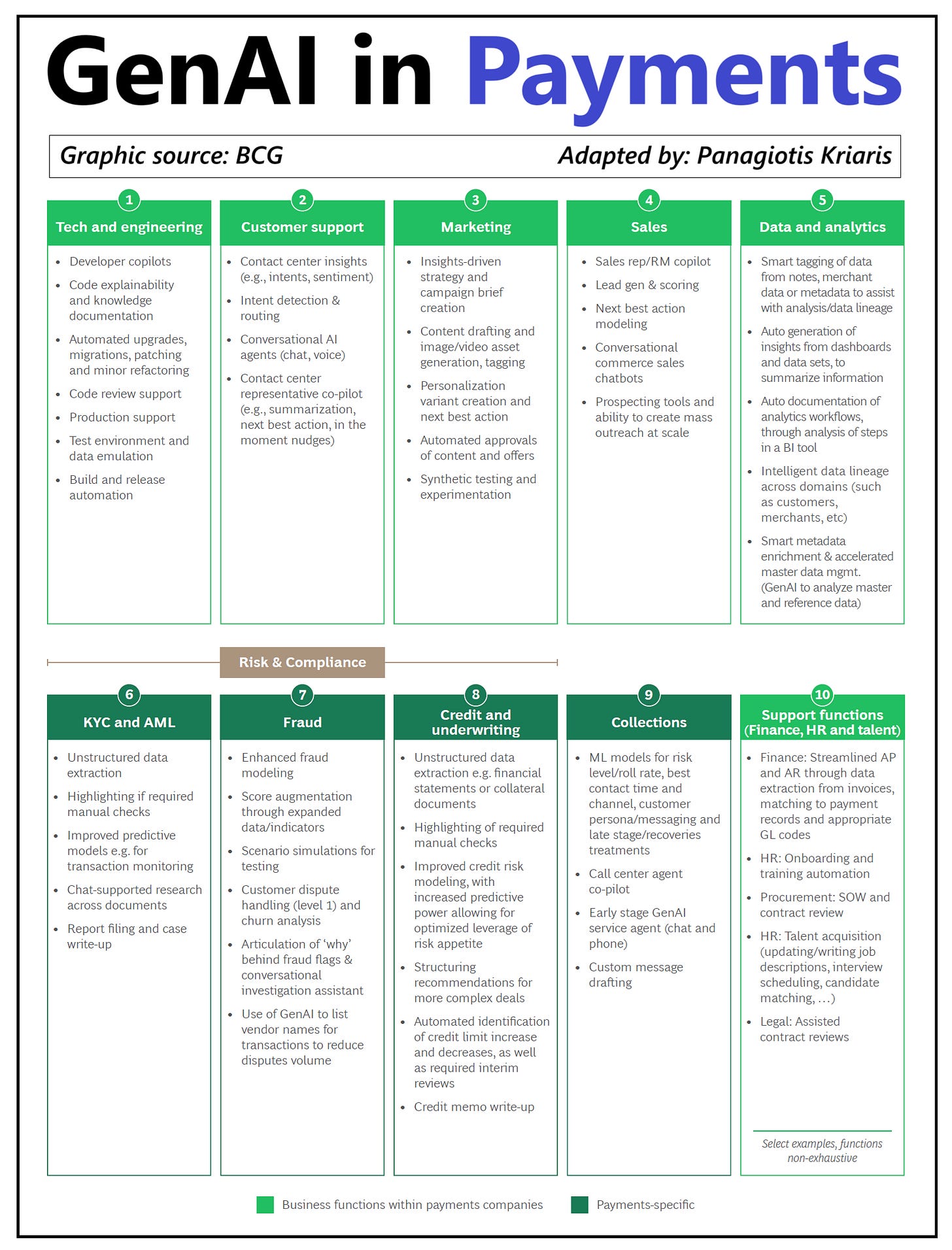

3) GenAI in Payments

GenAI is the biggest shift in payments since the cloud. And it’s no longer experimental but being fast hardwired into the industry's core infrastructure. Here's how.

𝗘𝗻𝗴𝗶𝗻𝗲𝗲𝗿𝗶𝗻𝗴: 𝗳𝗿𝗼𝗺 𝗱𝗮𝘆𝘀 𝘁𝗼 𝗵𝗼𝘂𝗿𝘀

Developer co-pilots, auto-migrations, and smart test environments mean code is now reviewed, written, and deployed in hours, not days. Entire release cycles are compressing - and costs with them.

𝗖𝘂𝘀𝘁𝗼𝗺𝗲𝗿 𝘀𝗲𝗿𝘃𝗶𝗰𝗲 𝗿𝗲-𝗶𝗻𝘃𝗲𝗻𝘁𝗲𝗱

Call centers are no longer just cost centers. With GenAI-powered routing, instant context generation, and smooth transitions between AI and human agents, payment providers are cutting handling time and upselling during support calls.

𝗠𝗮𝗿𝗸𝗲𝘁𝗶𝗻𝗴: 𝗳𝗮𝘀𝘁𝗲𝗿 𝗮𝗻𝗱 𝘀𝗺𝗮𝗿𝘁𝗲𝗿

From writing briefs to producing campaign assets and testing variations, GenAI enables teams to move quicker and spend less. It reduces reliance on agencies while improving control and consistency.

𝗦𝗮𝗹𝗲𝘀: 𝘀𝗺𝗮𝗿𝘁𝗲𝗿 𝗽𝗿𝗼𝘀𝗽𝗲𝗰𝘁𝗶𝗻𝗴 𝗮𝗻𝗱 𝗵𝗶𝗴𝗵𝗲𝗿 𝗰𝗼𝗻𝘃𝗲𝗿𝘀𝗶𝗼𝗻𝘀

Reps now get real-time recommendations, while AI takes care of prospecting and closes simple deals on its own. More time selling, less time in the CRM. According to estimates, that’s driving a 30-40% boost in upsell and lower churn.

𝗦𝗺𝗮𝗿𝘁𝗲𝗿 𝗱𝗮𝘁𝗮

GenAI helps organize messy data, trace where it comes from, and surface insights automatically. Turning data from a bottleneck into a growth driver.

𝗡𝗲𝘅𝘁-𝗚𝗲𝗻 𝗿𝗶𝘀𝗸 𝗮𝗻𝗱 𝗰𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲

KYC, fraud, underwriting: the most complex, manual-heavy, error-prone processes in payments are being restructured. GenAI helps extract unstructured data, simulate scenarios, and even write memos and case files - in seconds.

𝗖𝗼𝗹𝗹𝗲𝗰𝘁𝗶𝗼𝗻𝘀

Outbound timing, messaging, and offers are now GenAI-optimized per persona - identifying the best moment and method to reach each customer. Human agents get real-time prompts, AI handles the rest. The result: lower write-offs and improved recovery outcomes.

GenAI is breaking the trade-offs that defined payments for decades - cost vs. speed, scale vs. personalization, security vs. experience.

The companies leading the next wave aren’t just using AI - they’re rebuilding their payments infrastructure from the ground up, rethinking how everything operates, end to end.

If you're in payments and still thinking about GenAI as a trend, then you’re already playing catch-up.

Opinions: Panagiotis Kriaris, Graphic source: BCG

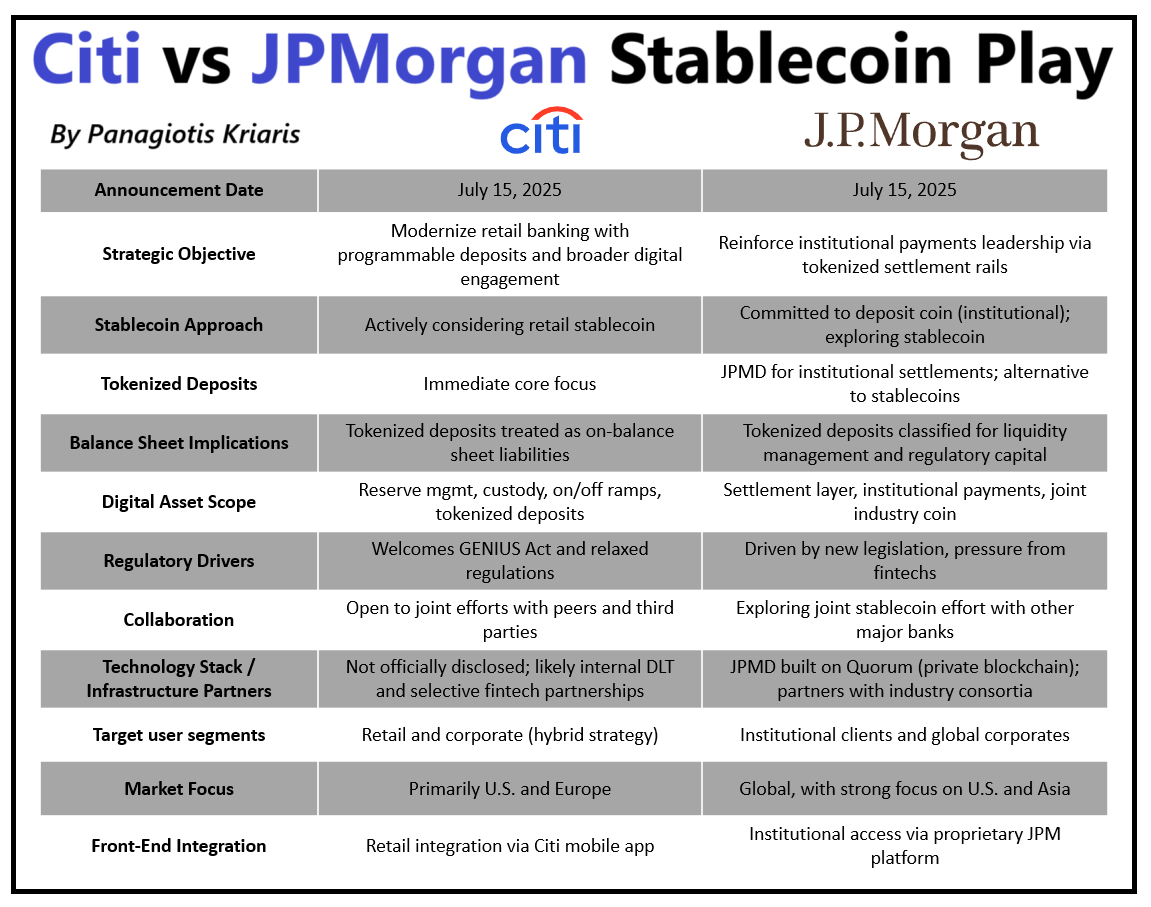

4) Citi vs JPMorgan Stablecoin Play

This is big news. Both Citi and JPMorgan unveiled major moves in stablecoins and digital assets on the same date - July 15. And it’s not a coincidence.

𝗪𝗵𝗮𝘁 𝗖𝗶𝘁𝗶 𝗮𝗻𝗻𝗼𝘂𝗻𝗰𝗲𝗱

— Citi is positioning itself at the intersection of retail and corporate finance, with a hybrid approach to digital assets.

— Actively exploring a retail-focused stablecoin, while making tokenized deposits its immediate strategic priority.

— These deposits are being integrated with custody, reserve management, and on/off ramps, all within Citi’s existing mobile infrastructure.

— Citi’s plan is not just to offer digital money - but to embed it into everyday financial experiences for both individuals and businesses.

𝗪𝗵𝗮𝘁 𝗝𝗣𝗠𝗼𝗿𝗴𝗮𝗻 𝗮𝗻𝗻𝗼𝘂𝗻𝗰𝗲𝗱

— JPMorgan, by contrast, is reinforcing its institutional-first digital money strategy.

— Building on its JPM Coin and Onyx platforms, it’s scaling up deposit tokens to support global settlements, liquidity, and payments.

— The focus is on improving efficiency for large corporates and financial institutions - no immediate retail expansion plans.

— Access will be through JPMorgan’s institutional platforms, with the bank working in industry groups to develop tokenized payment standards and interoperability.

𝗕𝗮𝗰𝗸𝗴𝗿𝗼𝘂𝗻𝗱

— Citi and JPMorgan are heading toward the same strategic goal - leadership in digital value infrastructure - but taking very different routes.

— Citi’s approach is customer-driven, aiming to grow wallet share, activate dormant accounts, and enable programmability in finance.

— JPMorgan’s strategy is infrastructure-led, reinforcing its role in global institutional payments and settlements.

— Citi targets broad consumer and business interaction, while JPMorgan deepens its institutional dominance.

The timing reflects three things:

1. Regulatory changes enabling stablecoin issuance by banks (e.g., the GENIUS Act).

2. Competitive dynamics from fintechs, Big Tech, and crypto-native entrants.

3. A strategic drive to influence emerging standards for digital money before frameworks are finalized

𝗜𝗺𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀

— Tokenized deposits can reshape banking - not just by lowering funding costs, but by opening new engagement channels.

— Interfaces are becoming control layers. For Citi, it’s the retail app; for JPMorgan, the institutional portal.

— Interoperability standards will be critical - they’ll define how digital money moves across banks, platforms, and ecosystems, and who gets to participate.

— Programmable transactions could automate complex financial products and enable real-time settlement

This isn’t just a stablecoin headline - it's a shift in how banks handle money in a digital environment. The next move is only a matter of time.

Opinions: Panagiotis Kriaris

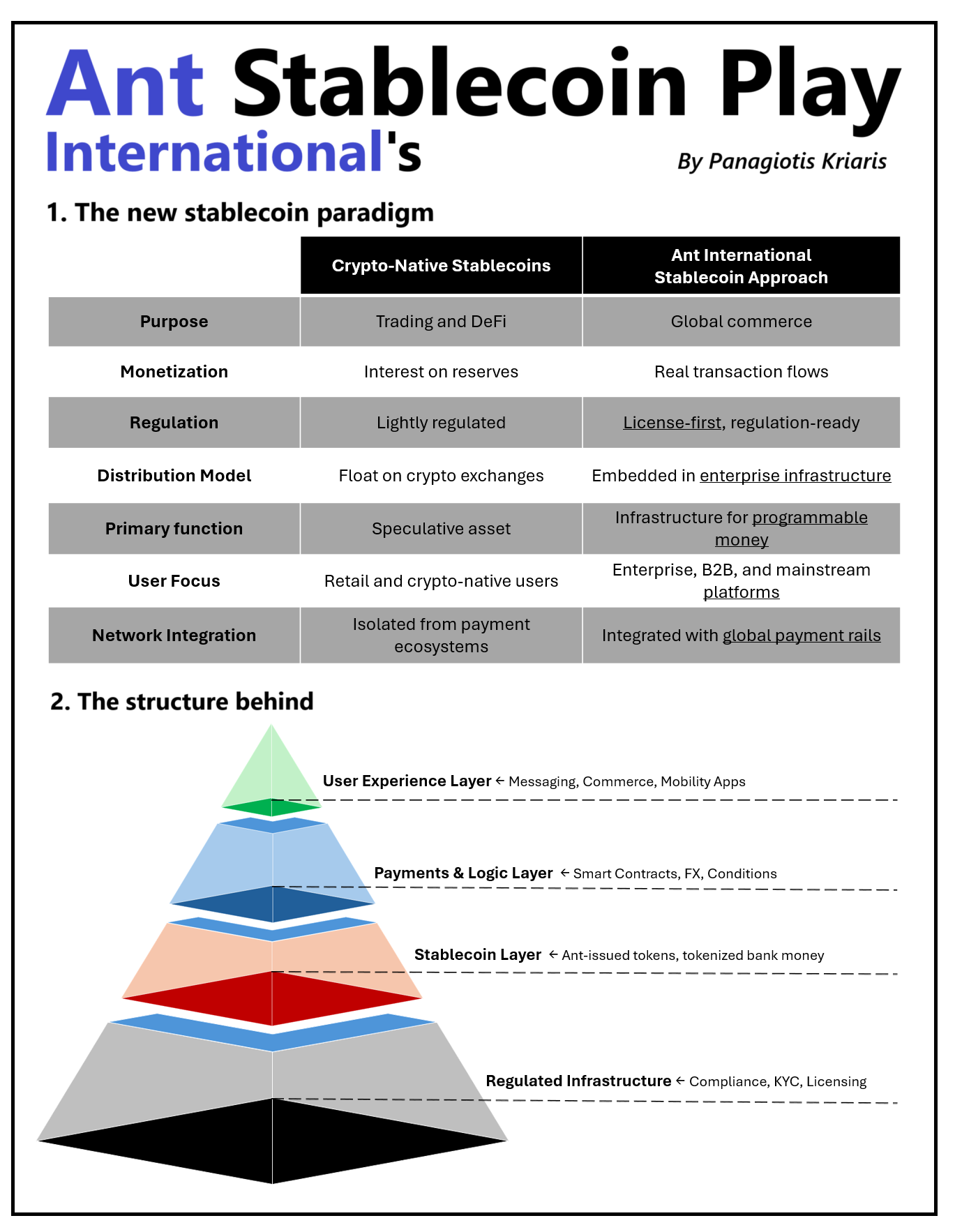

5) Ant International's Stablecoin Play

This isn’t just another stablecoin initiative. Ant International wants to rewrite the rules by embedding stablecoins into the global financial infrastructure instead of just floating them on crypto markets.

𝗪𝗵𝗮𝘁 𝘄𝗮𝘀 𝗮𝗻𝗻𝗼𝘂𝗻𝗰𝗲𝗱?

At Reuters NEXT APAC 2025, Ant International said it’s exploring stablecoin licenses - but not to list tokens on exchanges.

Ant is introducing a new paradigm that treats stablecoins as programmable infrastructure for payments and treasury, meaning that they can execute logic: trigger payments, convert currencies, or enforce rules automatically.

Examples:

- Instant FX: Stablecoins can convert currencies during transactions, cutting out intermediaries and reducing costs.

- Conditional payments: Smart contracts release funds only when terms are met (e.g. on delivery).

- Real-time liquidity: Stablecoin balances can move instantly across markets to optimize capital.

- Embedded compliance: KYC and transaction rules are coded into the token - reducing manual steps and risk.

𝗛𝗼𝘄 𝗶𝘀 𝘁𝗵𝗶𝘀 𝗰𝗵𝗮𝗻𝗴𝗶𝗻𝗴 𝘁𝗵𝗲 𝗴𝗮𝗺𝗲?

Most stablecoins today are crypto-native:

- Built for trading and DeFi

- Monetized through interest on reserves

- Often operate in lightly regulated environments

Ant’s approach flips that:

- Built for regulated global commerce

- Focused on payments, liquidity, and treasury

- Monetized through real transaction flows, not passive float

- Integrated into enterprise-scale financial infrastructure

𝗪𝗵𝘆 𝗱𝗼𝗲𝘀 𝗶𝘁 𝗺𝗮𝗸𝗲 𝘀𝗲𝗻𝘀𝗲?

- Ant processes over $1 trillion in global payments annually, with a third already moving on blockchain via tokenized bank deposits.

- It’s taking a licensing-first approach, working with regulators to align with financial frameworks.

- Through existing payment corridors, Ant connects with hundreds of banks, wallets, and providers across Asia and beyond — enabling immediate reach for stablecoin services.

- Ant owns the payment stack, so it can embed stablecoins natively into how money moves — not just layer them on top.

- Ant sees stablecoins as infrastructure for automating how money moves globally - cutting out batch processes, unlocking 24/7 liquidity, and reducing reliance on legacy rails.

𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝘆 𝗶𝗺𝗽𝗮𝗰𝘁:

- From passive store-of-value instruments to active tools for automating payments, FX, and liquidity

- From interest-based models to revenue from real transaction activity

- From isolated pilots to full integration in enterprise infrastructure

Ant’s model is a blueprint for how large fintechs can enter the space - not by replicating crypto strategies, but by integrating stablecoins into high-scale financial operations.

Opinions: Panagiotis Kriaris