1) Anatomy of a card 2) Banks hire AI 3) FinTech M&A deals, Europe 4) AI agents 5) Europe's top merchant acquirers

Welcome to my newsletter! Each week a few hand-picked topics from the world of fintech, payments and banking with behind-the-scenes analysis!

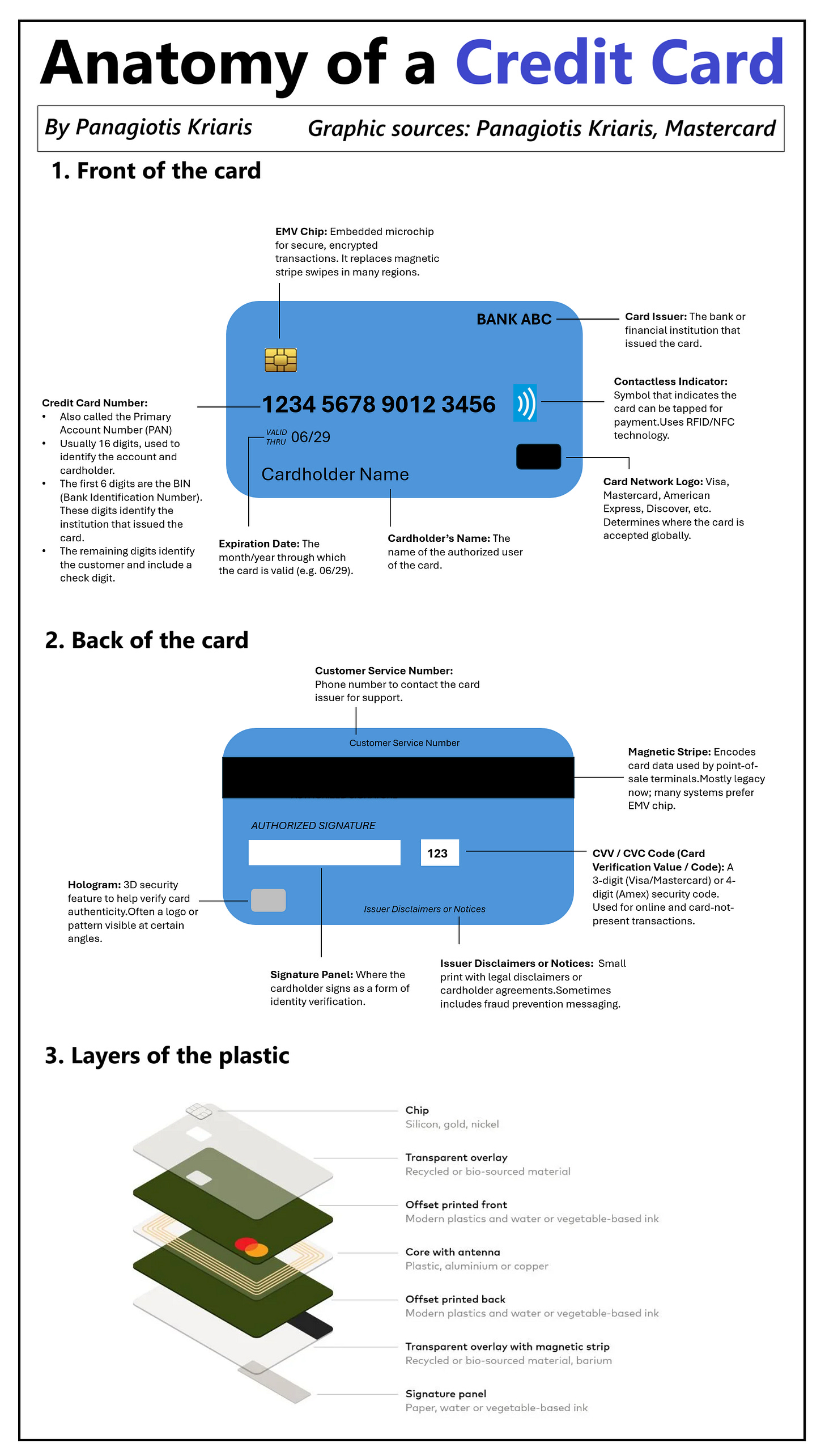

1) Anatomy of a credit card

Ever wondered what all those numbers, chips, and stripes on your credit card actually do?

What looks like a simple piece of plastic is actually a tightly engineered layer of financial infrastructure.

𝗙𝗿𝗼𝗻𝘁 𝗼𝗳 𝘁𝗵𝗲 𝗰𝗮𝗿𝗱:

- Card Issuer - The bank that issued the card.

- Card Network - Visa, Mastercard, Amex: the rails that move your money.

- Card Number (PAN) - The 16-digit identifier; the first 6 digits define the issuer, the last digit is a Luhn check.

- Cardholder Name - Who’s allowed to use the card.

- Expiration Date - When the card needs replacing.

- EMV Chip - Microprocessor for secure, encrypted transactions.

- Contactless Logo - Tap to pay via NFC.

𝗕𝗮𝗰𝗸 𝗼𝗳 𝘁𝗵𝗲 𝗰𝗮𝗿𝗱:

- Magnetic Stripe - Legacy tech still in use, but declining.

- Signature Panel - Fading from relevance but still present.

- CVV Code - For remote/online verification.

- Customer Helpline - First point of contact for support, disputes, or emergencies.

- Hologram - Physical anti-fraud marker.

𝗧𝗿𝗲𝗻𝗱𝘀 𝘁𝗼 𝘄𝗮𝘁𝗰𝗵:

- De-materialization: Physical cards are becoming backup - we’re moving from carrying cards to carrying credentials - invisible, tokenized, and embedded into every device.

- BIN evolution: More issuers are opening multi-currency BINs for cross-border capabilities and flexibility. In practise that means a single card can support spending in multiple currencies.

- CVV going dynamic: Some banks now issue cards with rotating CVVs or virtual cards for each transaction.

- Magnetic stripe sunset: Mastercard will phase out magnetic stripes by 2033 after 60+ years!

- Biometrics on card: Fingerprint sensors are being piloted for in-card authentication - PINs may soon be optional.

In a world where cards are swiped, tapped, tokenized, and embedded into wallets, the physical card still embodies identity, security, and trust. It may be legacy tech - but it remains a globally dominant access point to the financial system.

And despite the digital shift, plastic cards aren’t going away anytime soon – but they will continue to evolve.

Opinions: Panagiotis Kriaris, Graphic sources: Panagiotis Kriaris, Mastercard

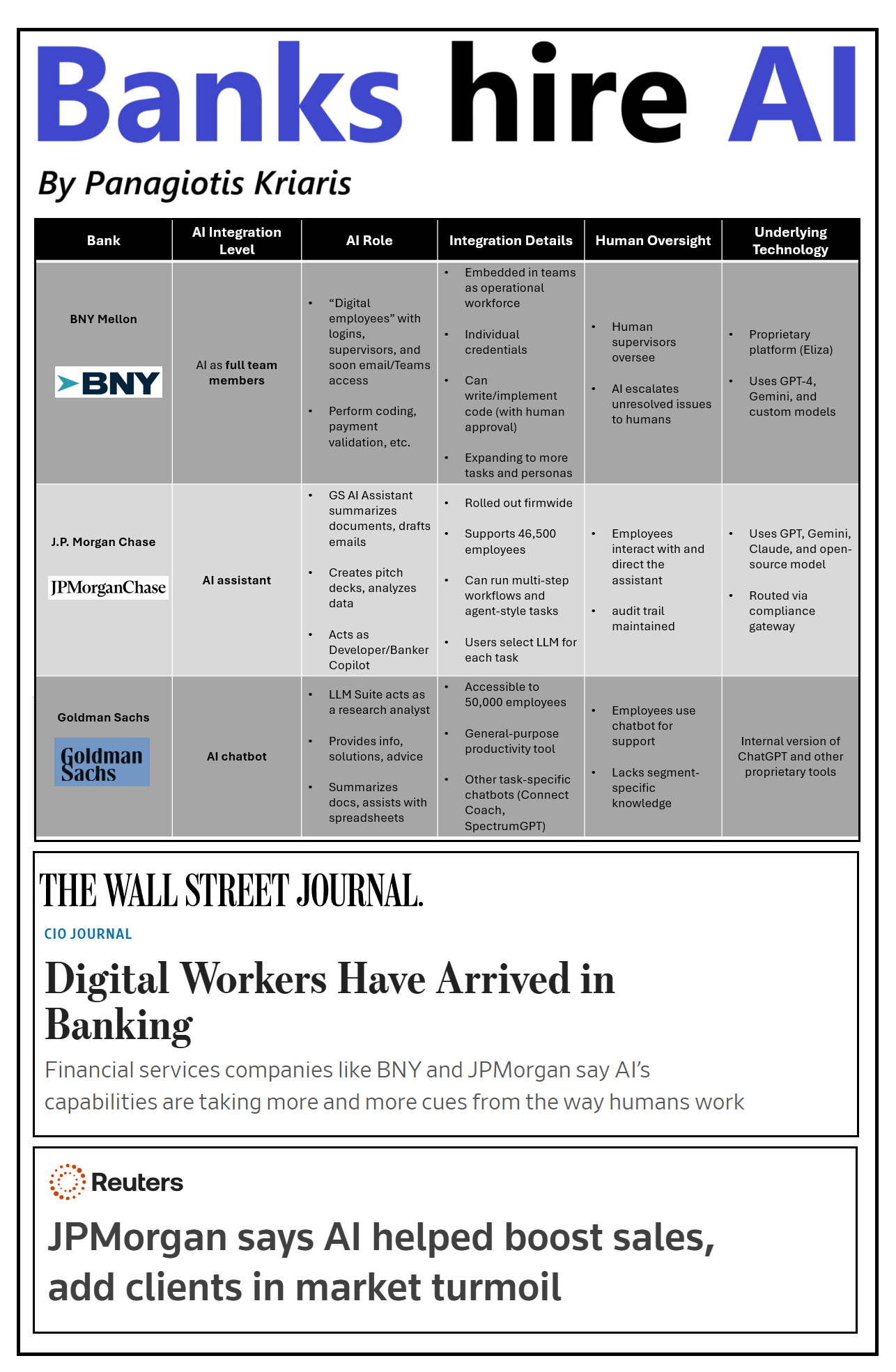

2) Banks hire AI

Banks aren’t just experimenting with AI- they’re hiring it.

It’s no longer science fiction. AI-powered workers are joining banking teams faster than anyone expected. Here’s what’s unfolding - and why it matters.

At BNY Mellon, AI agents are already embedded across departments, functioning much like human employees:

- They hold their own company credentials, logging into internal systems just like employees.

- Each AI agent is assigned to a specific team and operates within strict access limits for security.

- They do different tasks: one might specialize in fixing software vulnerabilities; another verifies payment instructions.

- These agents work independently, flagging completed tasks for human review rather than waiting for prompts.

- Plans are underway to give them access to internal communication tools like email and MS Teams.

- The goal: allow AI agents to reach out proactively when human input is needed - not just respond when asked.

- More specialized AI roles are in development, signaling broader integration across business functions.

- Human managers still oversee these agents, ensuring outputs align with company policies and compliance.

That’s a huge shift from the way most banks deploy AI today. These aren’t chatbots or background tools. They’re co-workers. And they will be multiplying.

𝗟𝗼𝘁𝘀 𝗼𝗳 𝗾𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀 𝘄𝗶𝗹𝗹 𝗮𝗿𝗶𝘀𝗲:

- What does collaboration look like when some team members are machines?

- How do you onboard, manage, and audit autonomous systems in daily workflows?

- What’s the playbook for a hybrid workforce of humans and AI?

This is a preview of a very near future where every knowledge worker will be paired with - or shadowed by - a digital counterpart.

𝗜𝗺𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀:

1. Faster remediation of critical systems

2. Reduced operational risk

3. Scalable problem-solving without adding headcount

4. A redefinition of what “hiring” even means

5. Embedded compliance and anomaly detection across workflows

6. Strategic redeployment of human talent to higher-value tasks

7. Real-time escalation and collaboration between AI and humans

8. A new model for workforce planning in hybrid teams

The age of AI co-pilots has arrived. The question isn’t whether banks will use them - it’s how fast they can adapt their operating models to make it work.

Opinions: Panagiotis Kriaris

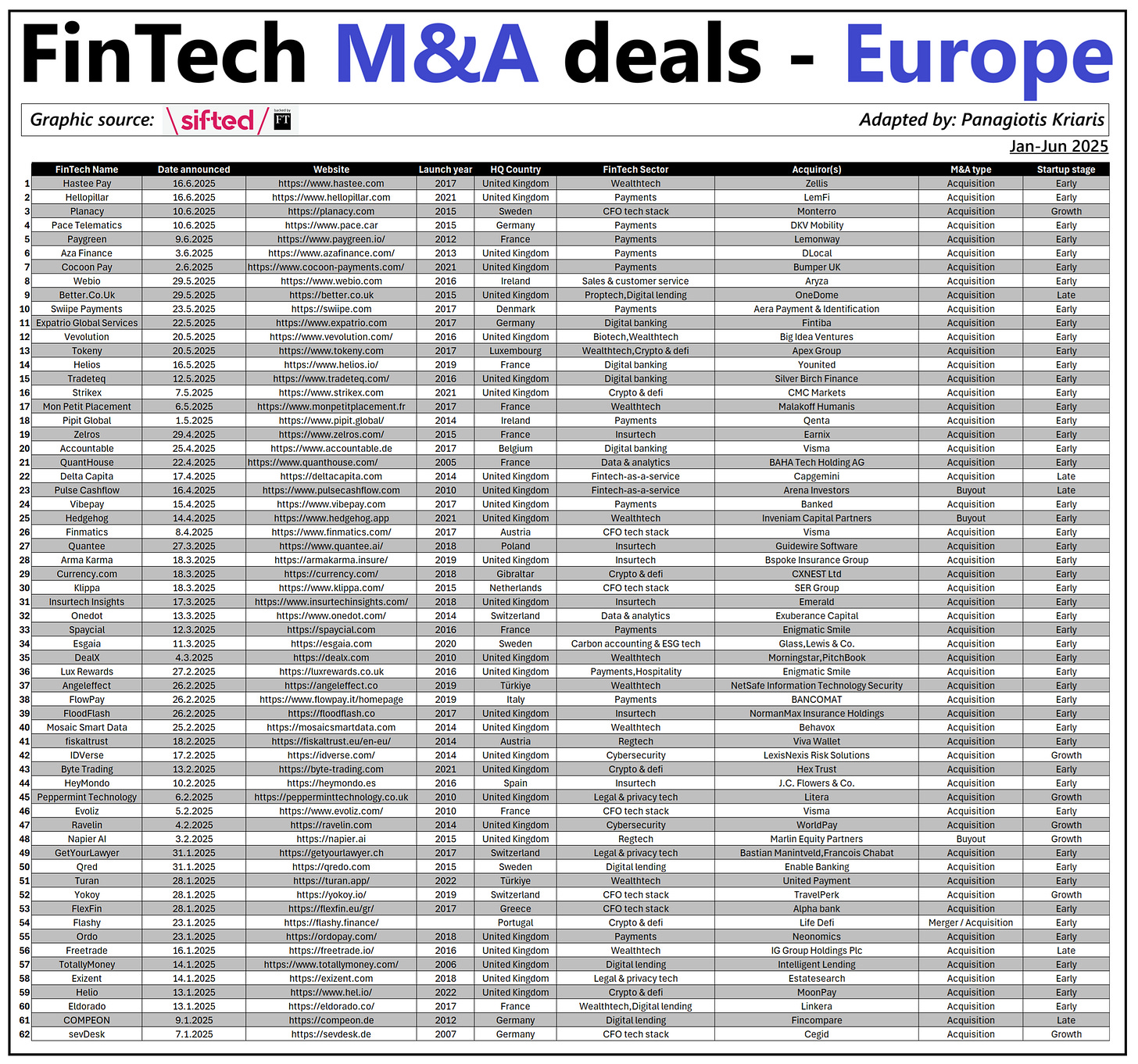

3) FinTech M&A deals - Europe

The list is out: 62 fintech acquisitions across Europe so far this year. But what do these deals really reveal about where the market is headed? Here’s my take.

The data is coming from Sifted.

𝗡𝘂𝗺𝗯𝗲𝗿𝘀’ 𝗼𝘃𝗲𝗿𝘃𝗶𝗲𝘄:

- Slight increase vs the same period last year (62 acquisitions and buyouts this year vs 57 last year).

- Payments leads (18% of all deals), followed by Wealthtech, CFO tech stacks, Insurtech, and Crypto/DeFi. These areas reflect fintech’s evolving role from front-end UX to back-end systems critical to digital finance.

- Nearly half of all acquisitions have targeted UK-based startups - 28 deals and counting - underscoring the UK’s role as a fintech hub with strong regulatory frameworks and ecosystem depth.

- France and Germany are also gaining traction, particularly in B2B infrastructure plays that support embedded finance and compliance.

𝗧𝗵𝗿𝗲𝗲 𝘁𝗵𝗲𝗺𝗲𝘀 𝘀𝘁𝗮𝗻𝗱 𝗼𝘂𝘁:

𝟭.𝗦𝗰𝗮𝗹𝗶𝗻𝗴 𝘂𝗻𝗱𝗲𝗿 𝘁𝗶𝗴𝗵𝘁𝗲𝗿 𝗰𝗮𝗽𝗶𝘁𝗮𝗹 𝗰𝗼𝗻𝗱𝗶𝘁𝗶𝗼𝗻𝘀: With interest rates no longer near zero, capital has become more expensive and harder to raise. Investors are pushing for profitability and disciplined growth. Many fintechs are responding by acquiring targeted capabilities instead of building them from scratch.

𝟮.𝗨𝗻𝗶𝗳𝘆𝗶𝗻𝗴 𝗰𝗮𝗽𝗮𝗯𝗶𝗹𝗶𝘁𝗶𝗲𝘀 𝗮𝗰𝗿𝗼𝘀𝘀 𝘁𝗵𝗲 𝘀𝘁𝗮𝗰𝗸: Whether it’s payment orchestration, embedded finance, or compliance tooling, buyers are looking to unify services and control more of the financial stack. Tighter integration, lower costs, and more control over the value chain.

𝟯. 𝗔𝗜 𝗶𝘀 𝗯𝗲𝗰𝗼𝗺𝗶𝗻𝗴 𝗳𝗼𝘂𝗻𝗱𝗮𝘁𝗶𝗼𝗻𝗮𝗹: Several acquisitions mention GenAI in areas like onboarding, KYC, document processing, and customer service. It’s not just an add-on - it’s quickly becoming essential infrastructure.

𝗪𝗵𝗮𝘁’𝘀 𝘁𝗵𝗲 𝗯𝗶𝗴 𝗽𝗶𝗰𝘁𝘂𝗿𝗲?

- We’ve entered a more disciplined fintech era. The M&A activity we’re seeing isn’t just consolidation for scale - it’s consolidation for resilience and relevance. The fintechs being acquired now are solving real problems and plugging into broader platforms with clear revenue models and regulatory readiness.

- What sets successful players apart is building GenAI, payments, and compliance into their core infrastructure - not treating them as add-ons.

What’s your take?

Opinions: Panagiotis Kriaris, Graphic and data source: Sifted, Tom Matsuda

Link to sifted list: https://sifted.eu/articles/fintech-acquisitions-2025

4) AI agents in E-commerce

OpenAI dropped something big: retailers can now embed AI shopping agents into their Shopify stores - in just a few clicks.

Through a new integration between the Storefront Managed Compute Platform (MCP) (Shopify’s tool for powering custom storefront features) and the OpenAI Responses API (controls how AI agents understand and respond to users), building a shopping assistant no longer requires authentication, custom code, or complex setup.

By adding a store URL to the OpenAI Playground (an easy-to-use web interface for testing and deploying AI agents), a fully functional assistant can be deployed almost instantly.

Once live, the AI assistant is capable of:

Searching the store’s live product catalog

Adding selected items to a shopper’s cart

Generating checkout links in real time

The interaction is seamless. A shopper might type, “I’m looking for a lightweight men’s button-up shirt for a vacation,” and the agent responds with curated options. Upon selection, the item is added to cart - autonomously and without delay.

The launch marks more than a product update - it’s a strategic step toward agentic commerce, where AI doesn't just inform but acts on behalf of the shopper. While OpenAI provides the intelligence and interface, Shopify is laying the groundwork for retailers to operationalize it at scale through tools like the Storefront Managed Compute Platform (MCP).

And it’s not alone.

- Perplexity offers one-click purchasing via Buy with Pro and is onboarding merchants through a free product data program.

- Google is enhancing Search and Bard with shopping intelligence, making results more shoppable — though still not fully agentic.

- Amazon is using generative AI in listings, reviews, and its Rufus assistant to improve discovery and streamline decisions.

- Startups like Cocoon and Cartwheel are building white-label AI agents for brands, turning chat into personalized storefronts.

We are clearly moving from search engines to shopping agents.

Opinions: Panagiotis Kriaris, Video source: Shopify Developers

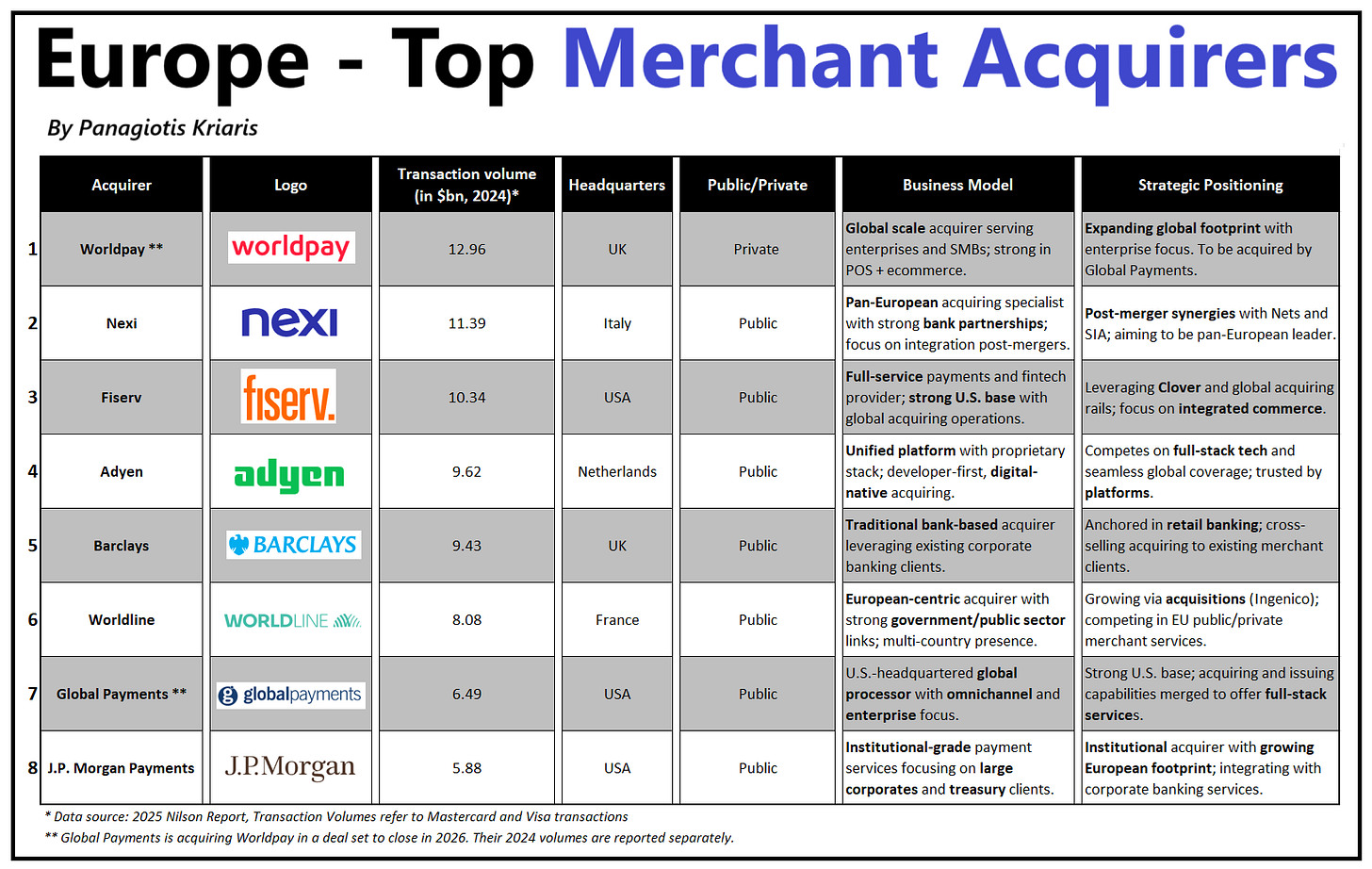

5) Europe's top merchant acquirers

Merchant acquirers are behind every card payment. But unlike banks or card brands, they get far less visibility. Here's my take on the European landscape.

A merchant acquirer enables businesses to accept card payments from customers. They process transactions, settle funds, and handle the connection to card networks.

In Europe, acquirers typically operate under one of two PSD2-regulated licenses:

• As an authorized payment or e-money institution

• As a credit institution (i.e., a bank)

𝗖𝗼𝗺𝗽𝗲𝘁𝗶𝘁𝗶𝗼𝗻 𝗮𝗻𝗮𝗹𝘆𝘀𝗶𝘀:

𝟭.𝗪𝗼𝗿𝗹𝗱𝗽𝗮𝘆 has global scale and strong enterprise and omnichannel capabilities. Privately owned, it's expanding internationally and serving large, complex merchants. Set to be acquired by Global Payments in 2026.

𝟮. 𝗡𝗲𝘅𝗶 is Europe’s top consolidator, integrating major acquisitions (Nets, SIA) while focusing on local expertise and deep bank relationships.

𝟯. 𝗙𝗶𝘀𝗲𝗿𝘃 combines US scale with global reach. It leverages its Clover platform and bank ties to deliver end-to-end commerce solutions.

𝟰. 𝗔𝗱𝘆𝗲𝗻 redefined acquiring with a developer-first, API-native model. Its single tech stack powers global platforms like Uber and Spotify.

𝟱. 𝗕𝗮𝗿𝗰𝗹𝗮𝘆𝘀 uses its universal banking position to support acquiring, cross-selling to merchants and embedding finance across its UK base.

𝟲. 𝗪𝗼𝗿𝗹𝗱𝗹𝗶𝗻𝗲 is Europe-focused, with strength in public sector and regulated verticals. Post-Ingenico, it’s expanding multi-country reach.

𝟳. 𝗚𝗹𝗼𝗯𝗮𝗹 𝗣𝗮𝘆𝗺𝗲𝗻𝘁𝘀 has a strong omnichannel presence, serving enterprises with integrated commerce. Its Worldpay acquisition will make it Europe’s largest acquirer.

𝟴. 𝗝.𝗣. 𝗠𝗼𝗿𝗴𝗮𝗻 𝗣𝗮𝘆𝗺𝗲𝗻𝘁𝘀 is gaining ground as a premium institutional-grade acquirer, embedding acquiring into treasury and cash management services.

𝗧𝗿𝗲𝗻𝗱𝘀:

- Shrinking margins: Interchange fee regulation, competitive pricing, and rising compliance costs are putting pressure on profitability.

- Alternative rails: Open Banking and A2A payments are maturing fast, promising lower-cost alternatives to cards - especially in e-commerce and bill payments.

- Embedded finance: Merchants increasingly expect acquiring to come bundled with value-added services - lending, payouts, loyalty - not just payment processing.

- Tech debt: Legacy acquirers face challenges modernizing infrastructure while competing with tech-native players like Adyen or Stripe.

- Regulation: PSD3, AML upgrades, and data protection rules are adding pressure, especially on KYC, onboarding, and cross-border flows.

- M&A Integration: Several players are still digesting mega-mergers, risking delays in platform unification and operational efficiency.

Opinions: Panagiotis Kriaris, Trx. volume source: 2025 Nilson Report